10 Setps va Loan MultiFamily & Investment Property

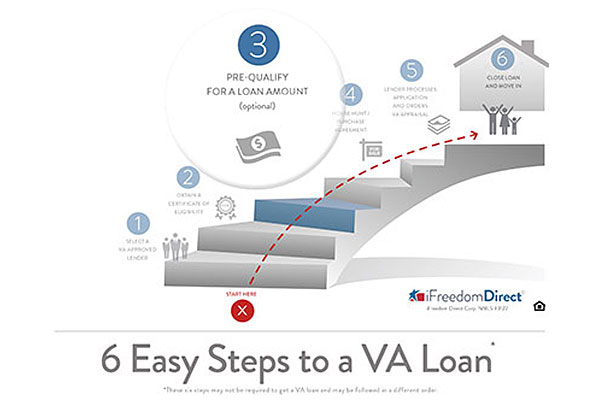

In the realm of real estate investment, finding the right financing can often be the key to unlocking significant opportunities. For veterans and active-duty service members in the United States, one such opportunity lies in utilizing VA loans to purchase multi-family homes. This unique approach not only supports homeownership but also offers a path to … Read more