How To Get Preapproved For a va Home Loan perfect home is an exciting journey, but navigating the financial aspects can sometimes feel daunting. For veterans and active-duty service members, the VA home loan program offers a fantastic opportunity to achieve homeownership with favorable terms. One of the crucial steps in this process is getting preapproved for a VA home loan, which not only streamlines your home search but also enhances your bargaining power with sellers. In this comprehensive guide, we’ll walk you through everything you need to know about VA home loan preapproval, from understanding the basics to preparing your application.

Understanding VA Home Loans

The VA home loan program, administered by the Department of Veterans Affairs, is designed to help veterans, active-duty service members, and eligible spouses buy, build, repair, or retain a home. What sets VA loans apart from conventional loans are their competitive interest rates, lower closing costs, and most importantly, the option to purchase a home with no down payment in many cases. These loans are guaranteed by the VA, which means lenders face less risk, making it easier for veterans to qualify.

Benefits of Getting Preapproved

Preapproval is a crucial first step in the VA home buying process. It involves a lender reviewing your financial situation and determining the maximum amount they are willing to lend you based on your income, credit history, and other factors. Here’s why getting preapproved is beneficial:

- Know Your Budget: Preapproval gives you a clear idea of how much house you can afford, helping you narrow down your home search to properties within your budget.

- Competitive Edge: Sellers often prefer buyers who are preapproved because it indicates you are a serious and qualified buyer. This can be particularly advantageous in a competitive market.

- Faster Closing: Since much of the initial paperwork is already done during preapproval, the time it takes to close on a home can be significantly reduced.

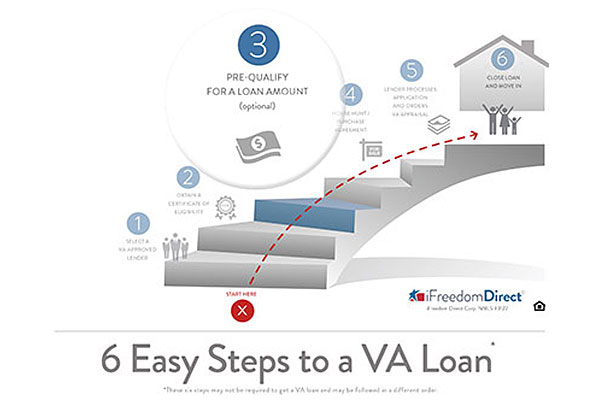

Steps to Get Preapproved for a VA Home Loan

1. Check Eligibility

Ensure you meet the eligibility criteria for a VA loan. Generally, veterans, active-duty service members with at least 90 days of continuous service during wartime or 181 days during peacetime, National Guard members, reservists, and eligible spouses may qualify.

2. Gather Required Documents

To complete your preapproval application, you’ll need several documents handy, including:

- Proof of military service (DD Form 214)

- Certificate of Eligibility (COE) from the VA

- Proof of income (pay stubs, W-2 forms, tax returns)

- Proof of assets (bank statements, investment accounts)

- Identification (driver’s license, passport)

3. Choose a VA-Approved Lender

Not all lenders offer VA loans, so it’s essential to select a lender approved by the VA. These lenders are well-versed in the intricacies of VA loans and can guide you through the process.

4. Complete the Preapproval Application

Submit your application to the chosen lender. They will review your financial information, credit history, and other relevant factors to determine your eligibility for a VA loan and the amount you can borrow.

5. Receive Your Preapproval Letter

If approved, you’ll receive a preapproval letter stating the loan amount for which you qualify. This letter is crucial when making an offer on a home as it demonstrates your financial readiness to the seller.

6. Begin Your Home Search

Armed with your preapproval letter, you can confidently start your home search within your budget range. Work closely with a real estate agent who understands VA loans and can help you find properties that meet your criteria.

7. Final Loan Approval

Once you’ve found your dream home and have an accepted offer, your lender will move forward with finalizing your loan application. This process includes a home appraisal and ensuring all necessary documentation is in order.

8. Close on Your Home

After final loan approval, you’ll attend a closing meeting where you’ll sign paperwork, pay any remaining closing costs, and receive the keys to your new home!

Tips for a Smooth Preapproval Process

- Maintain Good Credit: Pay your bills on time and keep your credit utilization low to maintain a healthy credit score.

- Organize Your Finances: Keep all necessary documents organized and readily accessible to streamline the preapproval process.

- Communicate with Your Lender: Stay in touch with your lender throughout the process to address any questions or concerns promptly.

Conclusion

Achieving preapproval for a VA home loan is an empowering first step towards homeownership for veterans and active-duty service members. By understanding the process, gathering necessary documents, and working with a knowledgeable lender, you can navigate the journey with confidence. Remember, each step brings you closer to unlocking the door to your dream home—a place where memories will flourish and roots will grow. Embrace the journey and enjoy the process of finding a home that not only meets your needs but also fulfills your aspirations.

In conclusion, getting preapproved for a VA home loan is a strategic move that sets you on the path to homeownership with confidence and clarity. With the VA’s support and a trusted lender by your side, you’re well-equipped to make informed decisions and secure the home you’ve always wanted.