In the complex landscape of insurance, individuals and businesses often turn to professionals known as insurance brokers to help them navigate the myriad options and find the best coverage for their needs. These brokers play a crucial role in the insurance industry, acting as intermediaries between insurance buyers and insurance companies. Their expertise lies in understanding the nuances of insurance policies, assessing risks, and securing appropriate coverage at competitive rates. This article delves into the role of insurance brokers, their responsibilities, and the benefits they bring to the table.

What is an Insurance Broker?

An insurance broker is a licensed professional who serves as an intermediary between insurance buyers and insurers. Unlike insurance agents who typically work for one insurance company and sell its products, brokers work independently and are not tied to any specific insurer. This independence allows them to offer unbiased advice and access a wide range of insurance products from various companies.

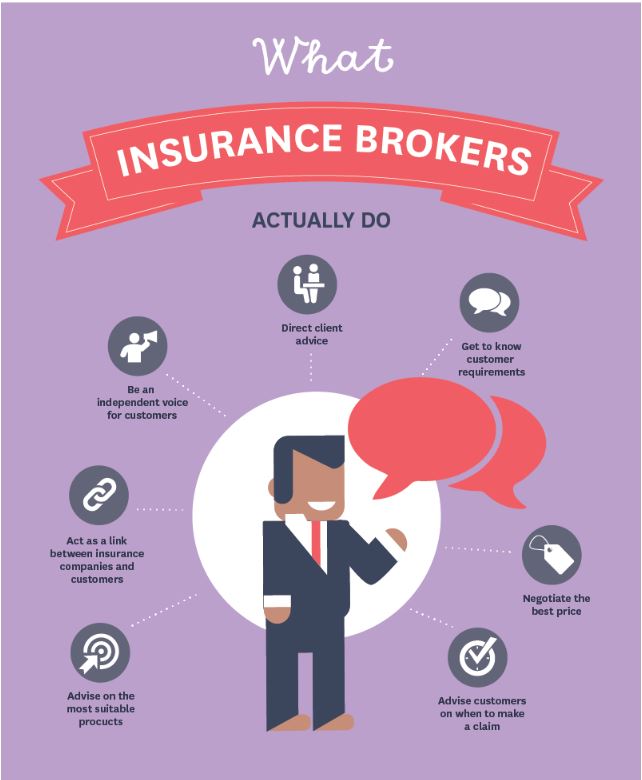

Responsibilities of Insurance Brokers

Insurance brokers have diverse responsibilities aimed at assisting clients in managing their insurance needs effectively. These responsibilities include:

- Assessment of Client Needs: Brokers start by assessing the insurance needs of their clients. This involves understanding the risks they face, both personally and professionally.

- Risk Analysis: Once needs are assessed, brokers conduct a thorough analysis of the risks involved. This step is crucial in determining the types and levels of insurance coverage required.

- Market Research: Brokers then research the insurance market to identify suitable policies from multiple insurers. This process involves comparing coverage options, premiums, terms, and conditions.

- Recommendations and Advice: Based on their analysis, brokers provide recommendations to clients regarding the most appropriate insurance solutions. They explain the details of each policy option, including benefits, limitations, and exclusions.

- Negotiation: Brokers negotiate with insurance companies on behalf of their clients to obtain the best possible terms, coverage, and premiums.

- Policy Management: Once a policy is selected, brokers assist with the implementation and management of the insurance program. They ensure that all paperwork is completed accurately and facilitate communication between the client and the insurer.

- Claims Assistance: In the event of a claim, brokers support their clients throughout the claims process. They help prepare and submit claims documents and advocate for fair and timely claim settlements.

- Continuous Review: Insurance needs evolve over time due to changes in circumstances or regulations. Brokers regularly review their clients’ insurance portfolios to ensure that coverage remains adequate and cost-effective.

Benefits of Using an Insurance Broker

Using an insurance broker offers several advantages to individuals and businesses:

- Expertise and Advice: Brokers have in-depth knowledge of insurance products and market trends. They provide expert advice tailored to the specific needs and circumstances of their clients.

- Choice and Access: Brokers have access to a wide range of insurance products from multiple insurers. This enables clients to compare options and find policies that best fit their requirements.

- Time Savings: Brokers handle the legwork involved in insurance shopping, saving clients time and effort. They simplify the process by explaining complex insurance terms and conditions.

- Cost Savings: Brokers leverage their industry relationships and negotiation skills to secure competitive premiums and favorable policy terms for their clients.

- Personalized Service: Brokers offer personalized service, taking the time to understand each client’s unique situation and providing ongoing support as insurance needs change.

Licensing and Regulation

Insurance brokers are required to obtain a license from state regulatory authorities to practice. Licensing requirements vary by jurisdiction but typically include passing examinations demonstrating knowledge of insurance principles, ethics, and applicable laws. Brokers must adhere to strict ethical standards and regulatory guidelines to protect the interests of their clients.

Types of Insurance Brokers

There are different types of insurance brokers specializing in various areas of insurance, including:

- Personal Lines Brokers: Specialize in insurance products for individuals, such as auto, home, and health insurance.

- Commercial Lines Brokers: Focus on insurance solutions for businesses, including property, liability, and employee benefits coverage.

- Reinsurance Brokers: Work with insurance companies to obtain reinsurance coverage to mitigate large or complex risks.

- Specialty Brokers: Handle niche insurance products, such as marine, aviation, or cyber insurance, which require specialized knowledge and expertise.

Conclusion

Insurance brokers play a pivotal role in helping individuals and businesses navigate the complexities of insurance. By providing expert advice, access to multiple insurance options, and personalized service, brokers empower their clients to make informed decisions and mitigate risks effectively. Their commitment to professionalism, ethical conduct, and client advocacy ensures that insurance needs are met comprehensively and competitively in a dynamic and ever-changing insurance market. Whether securing coverage for personal assets or managing complex commercial risks, the expertise of insurance brokers remains indispensable in safeguarding against the uncertainties of tomorrow.

In essence, insurance brokers are not just intermediaries; they are trusted advisors and partners in risk management, dedicated to delivering value and peace of mind through tailored insurance solutions.